What the Committee Does

The Banking Committee writes and oversees laws governing banks, credit unions, securities markets, and key financial regulators such as the Federal Reserve and FDIC. It handles legislation on housing finance, affordable housing programs, and development initiatives in cities and rural communities. The committee also manages major pieces of sanctions and export-control policy that use financial tools to advance U.S. national security.

Members regularly question regulators, industry leaders, and advocates on issues ranging from interest rates and capital standards to discrimination in lending and fintech innovation. The committee’s decisions affect mortgage rates, access to small business credit, and how safely household savings are protected. Through both bipartisan and partisan fights, it helps decide how much risk the financial system and the broader economy can bear.

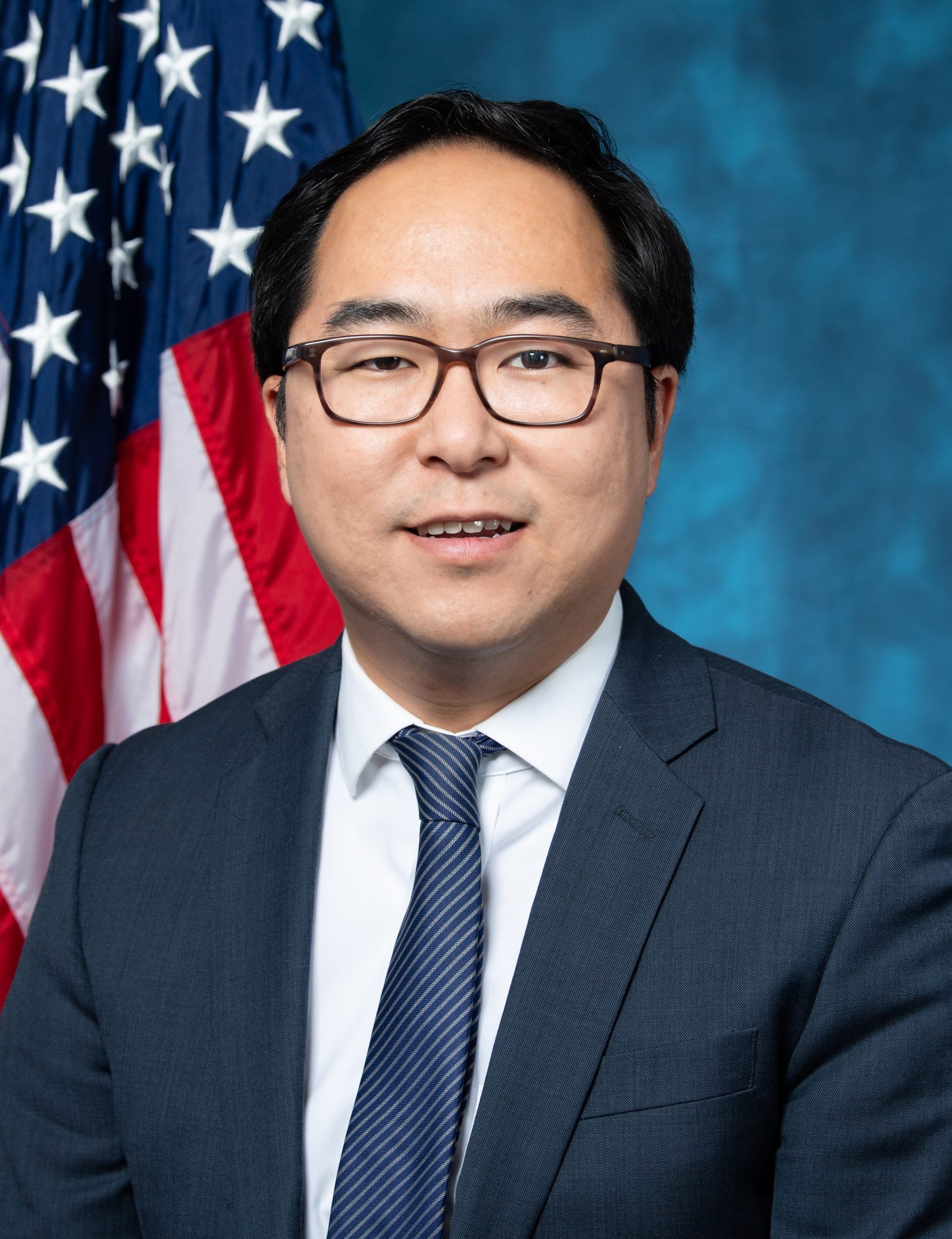

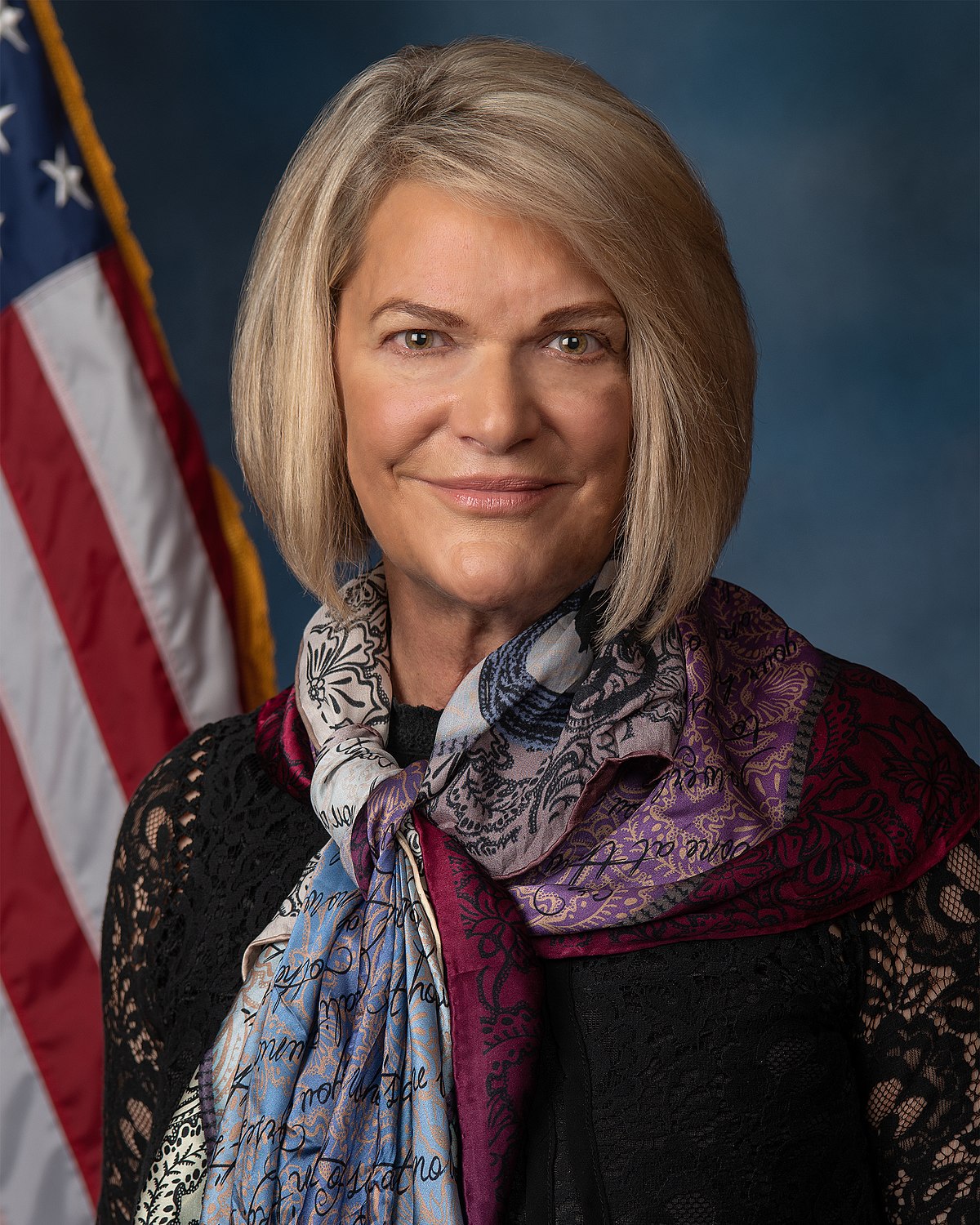

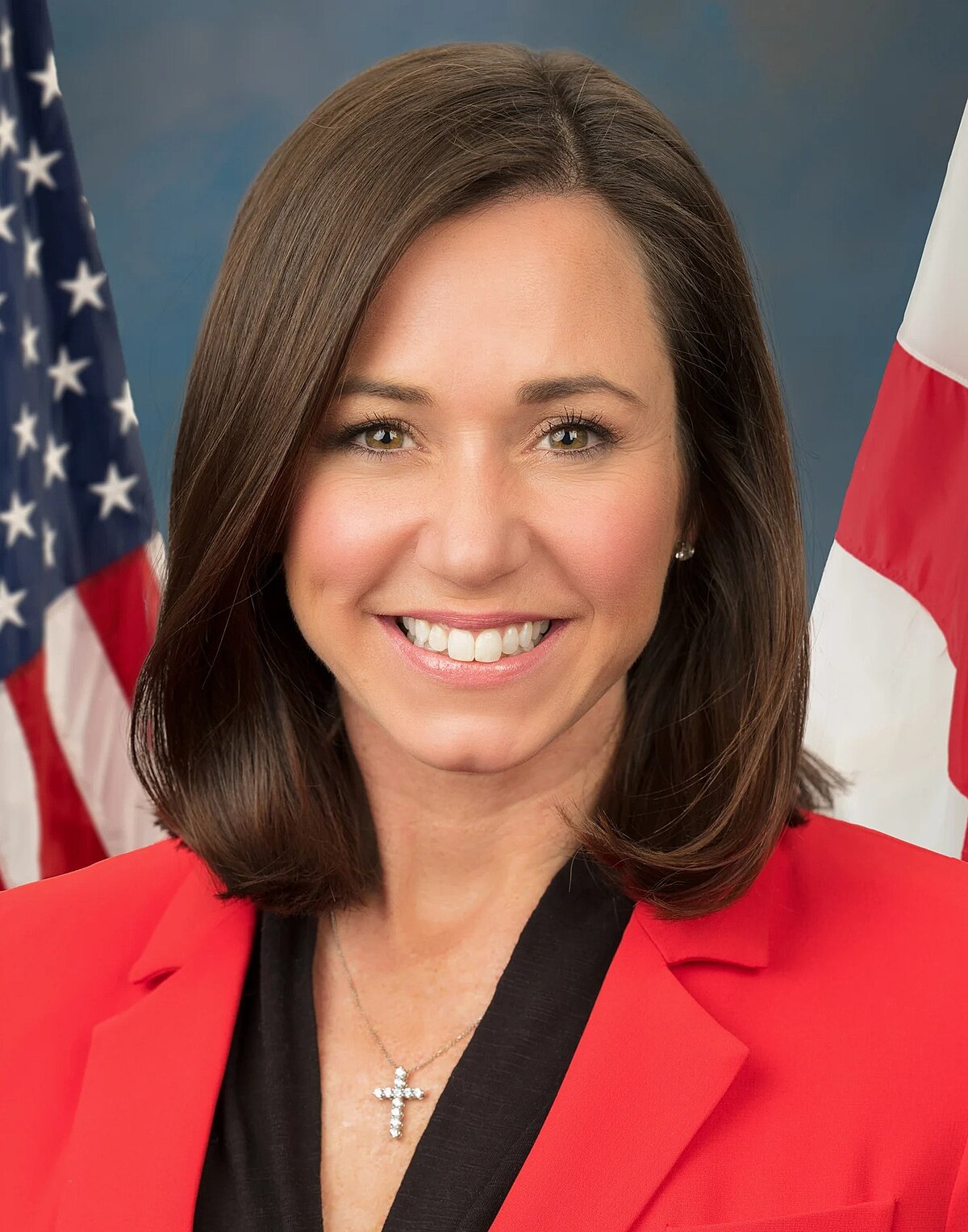

Committee Membership

Warren (Ranking Member) appears at the far left of the outer arc; Tim Scott (Chair) at the far right. Democrats cluster on the left, Republicans on the right.

Key Banking, Housing & Urban Affairs Measures

Recent financial, consumer, and regulatory actionsMaintaining American Superiority by Improving Export Control Transparency Act

This law requires clearer reporting and transparency around U.S. export controls, especially for technologies with national security implications. By improving data and communication, it aims to help Congress and the public understand how controls affect American competitiveness and security. It also signals to allies and adversaries alike that the United States is modernizing its export-control toolkit for a more contested global economy.

Miracle on Ice Congressional Gold Medal Act

The bill awards the Congressional Gold Medal to the 1980 U.S. Olympic Men’s Ice Hockey Team, commemorating the “Miracle on Ice.” It recognizes the team’s upset victory over the Soviet Union as a defining moment in Cold War–era sports and American culture. By moving through both chambers with broad bipartisan support, the measure underscores how symbolic achievements can still unify the country.

Disapproving CFPB Rule on "General-Use Digital Consumer Payment Applications"

This joint resolution overturns a Consumer Financial Protection Bureau rule defining larger participants in the digital payments app market. Supporters argue the rule was overly expansive and risked stifling innovation in fintech and consumer payment platforms. By disapproving the rule, Congress reasserts its authority over how big new financial-technology players are regulated.

Disapproving CFPB Rule on "Overdraft Lending: Very Large Financial Institutions"

The law nullifies a CFPB rule that would have tightened restrictions on overdraft practices at very large banks. Proponents contend the rule could have reduced access to short-term liquidity tools for some consumers and increased account fees. The resolution instead favors existing disclosure-based approaches while keeping pressure on regulators to monitor abusive practices.

Disapproving OCC Bank Merger Review Rule under the Bank Merger Act

This joint resolution overturns an Office of the Comptroller of the Currency rule that changed how the agency reviews proposed bank mergers. Lawmakers backing the measure worry the rule could have either chilled competitive combinations or failed to safeguard consumers and financial stability. By disapproving it, Congress forces regulators back to the drawing board on how to evaluate consolidation in the banking sector.