What the Committee Does

The Finance Committee writes and oversees the federal tax code, trade laws, and major entitlement programs that shape the U.S. economy. It has jurisdiction over individual and corporate taxes, tariffs and trade agreements, Social Security, Medicare, and many health-care financing policies.

The committee supervises the Department of the Treasury, the Internal Revenue Service (IRS), and trade functions in the executive branch, as well as programs that provide benefits to retirees, low-income families, and people with disabilities. Its work affects everything from take-home pay and prescription drug costs to the competitiveness of U.S. exports.

Led by the Chair and Ranking Member, the committee holds hearings with economists, administration officials, business leaders, and advocacy groups. Finance bills often become the vehicles for major tax changes, trade sanctions or relief, and reforms to the social safety net.

Committee Membership

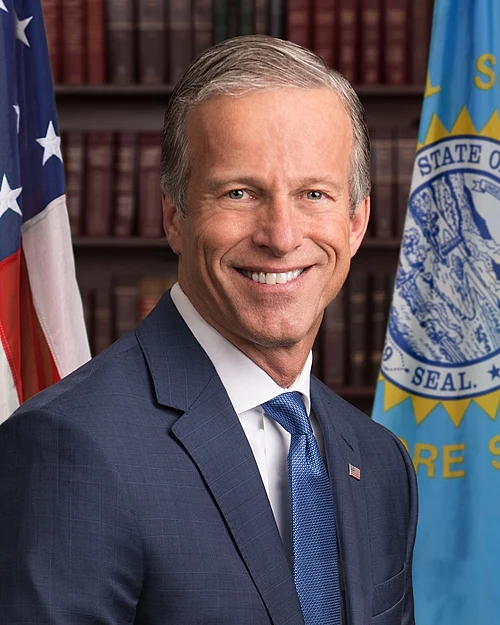

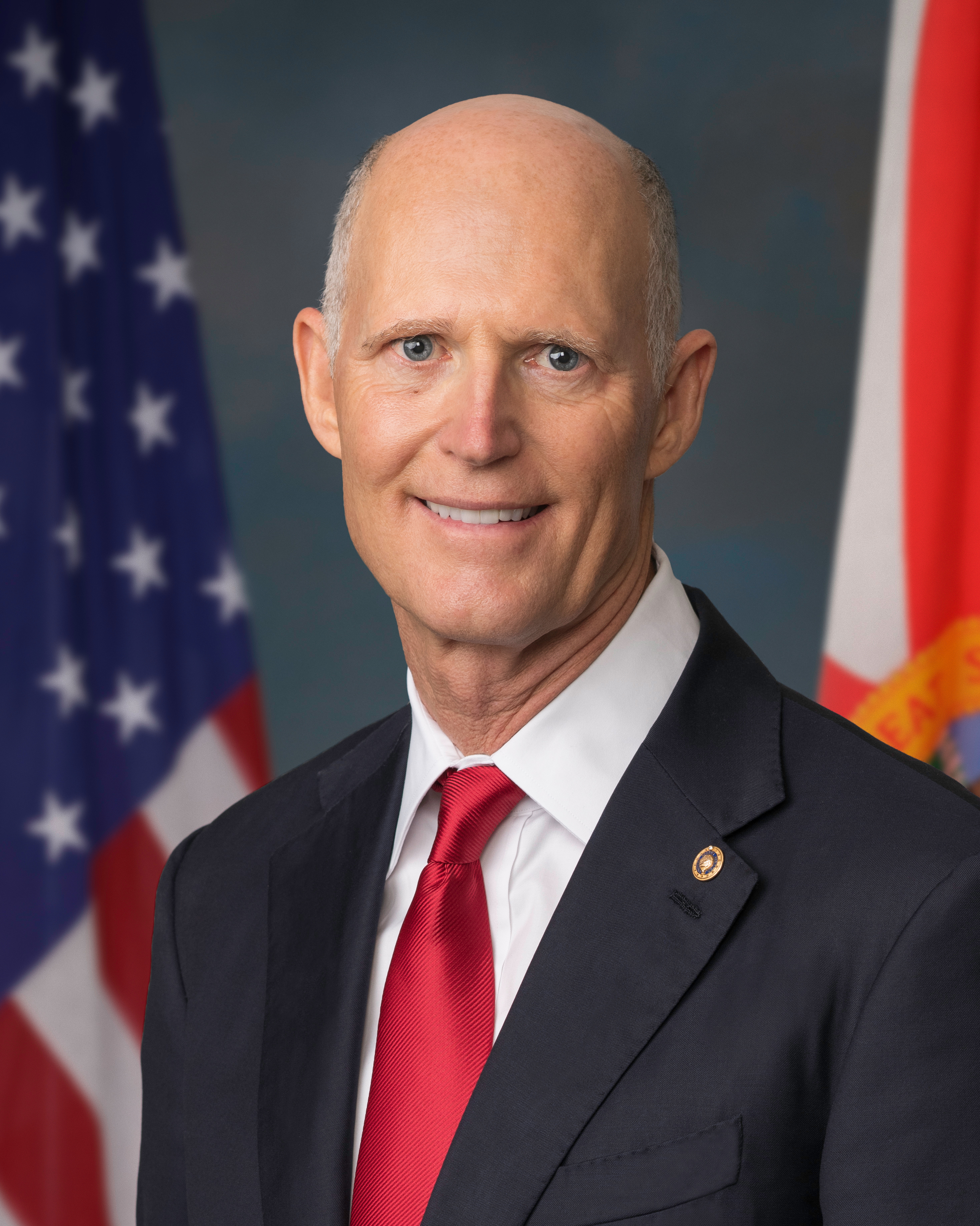

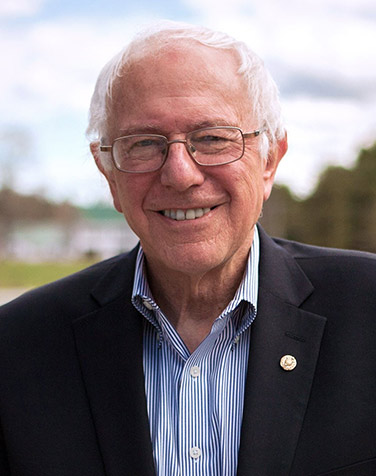

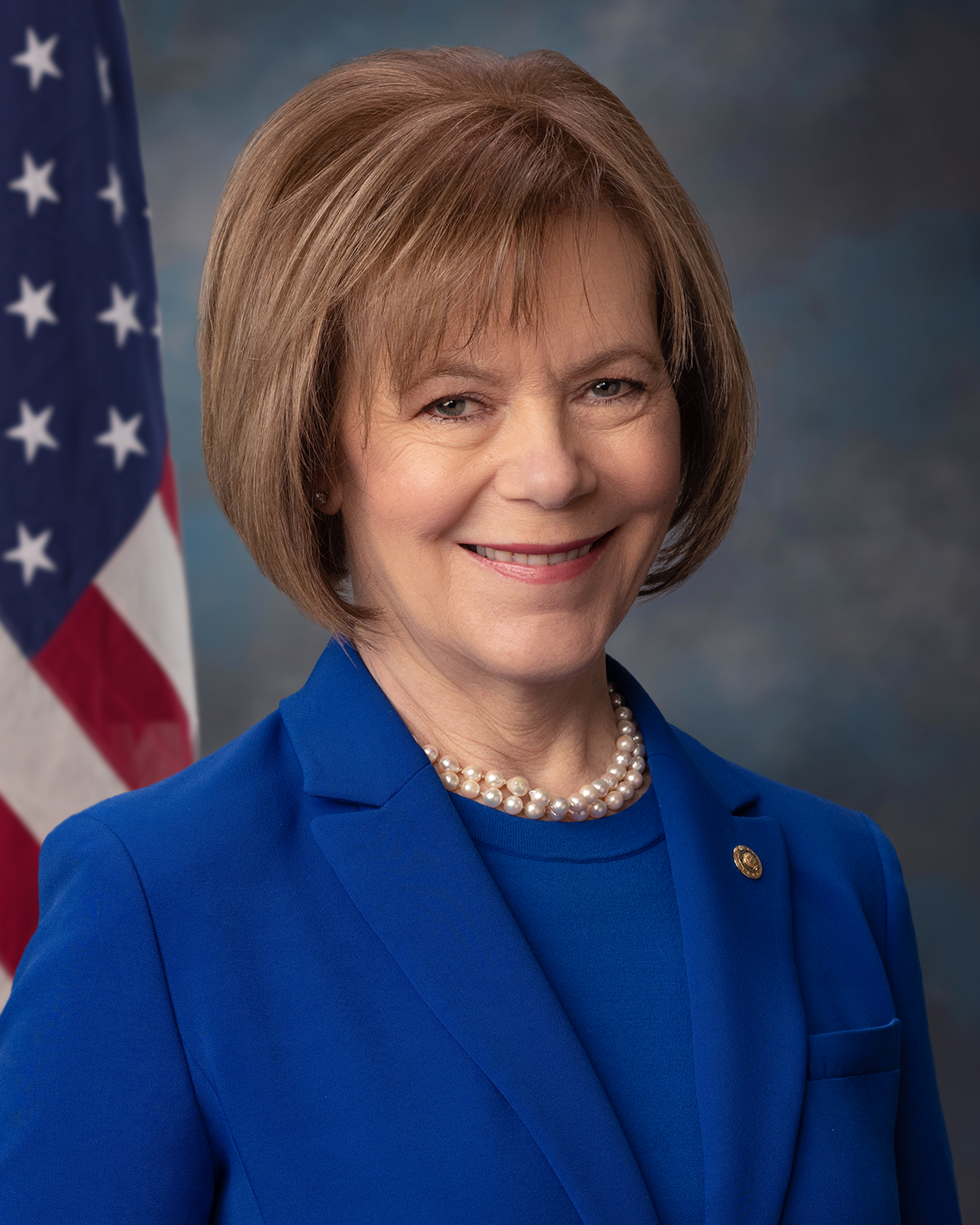

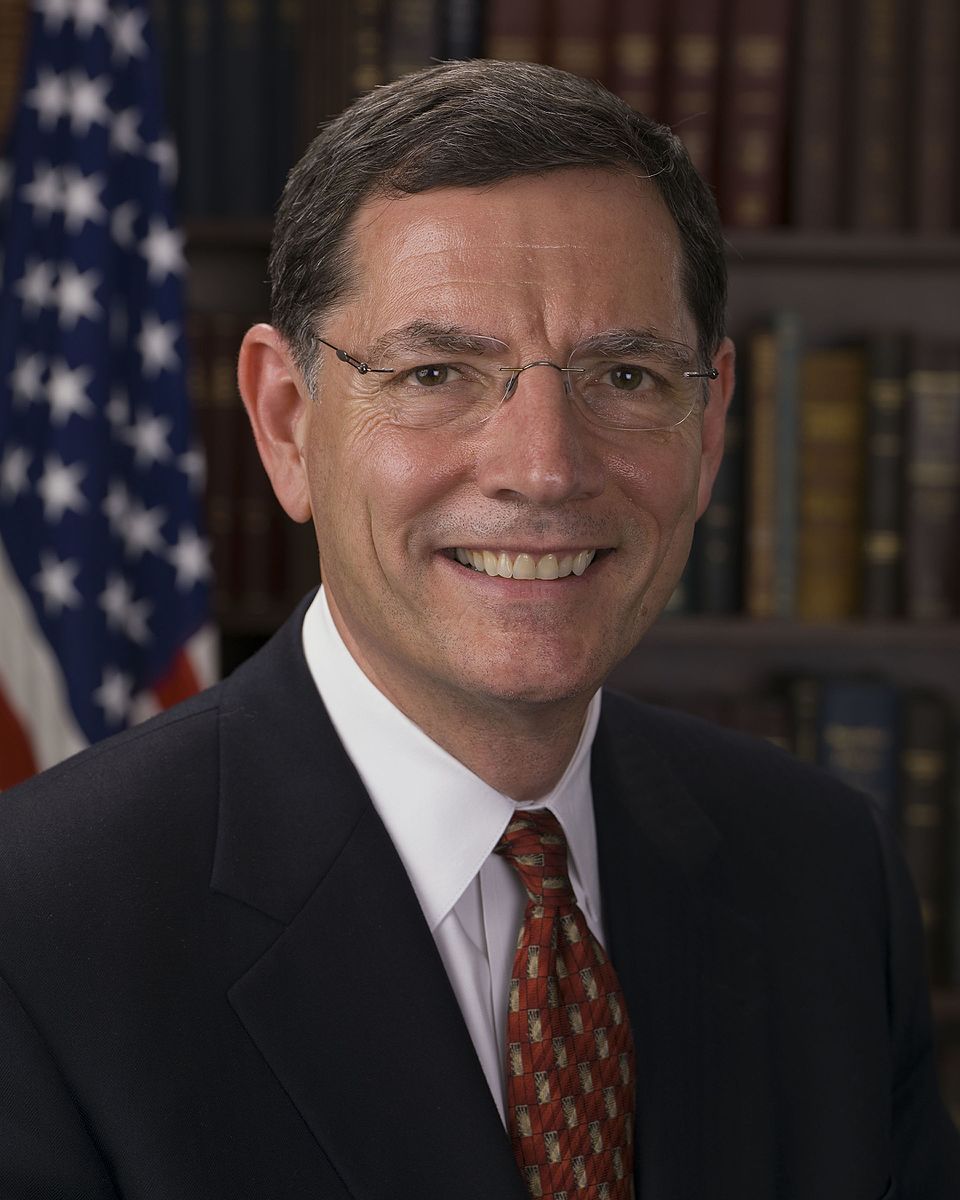

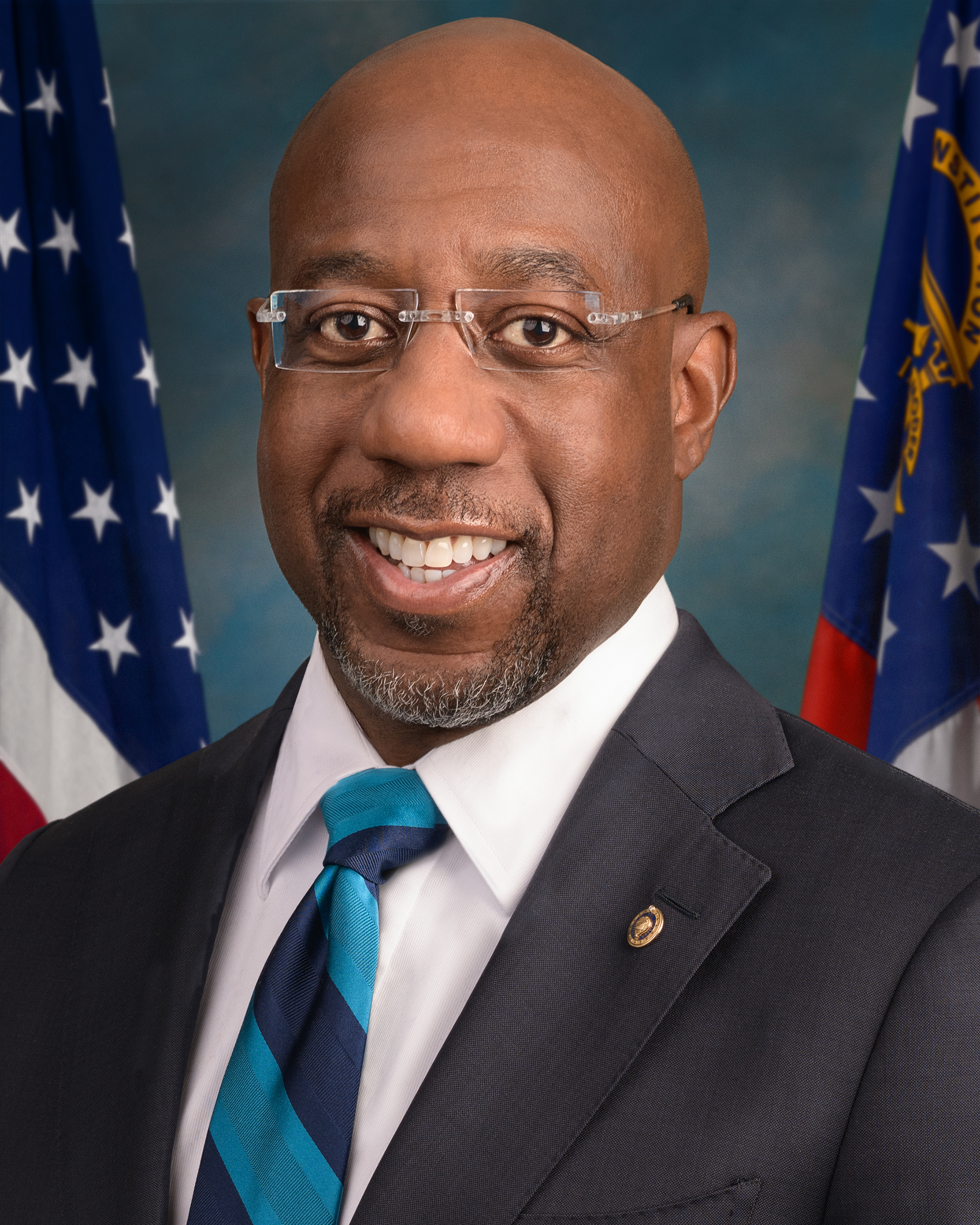

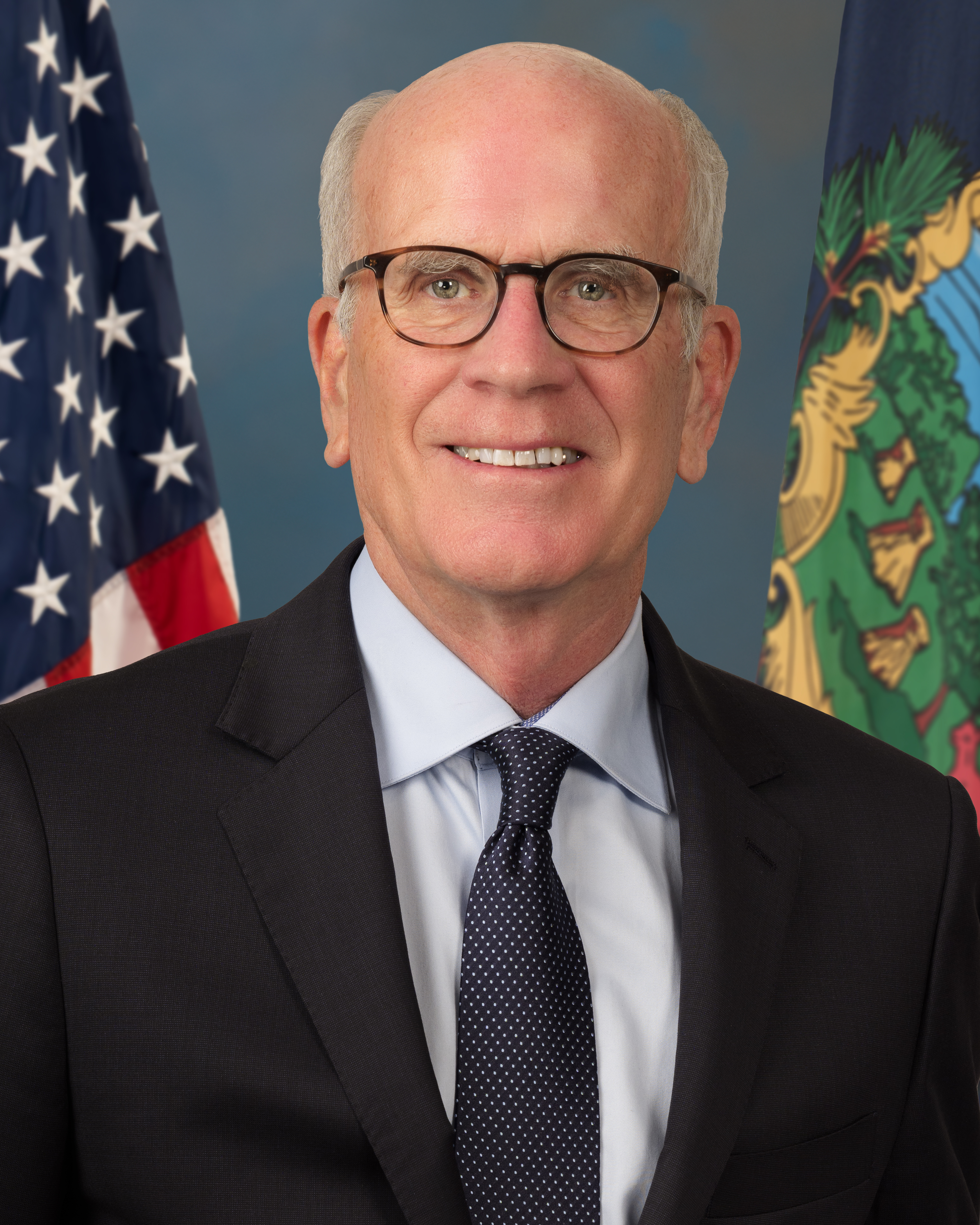

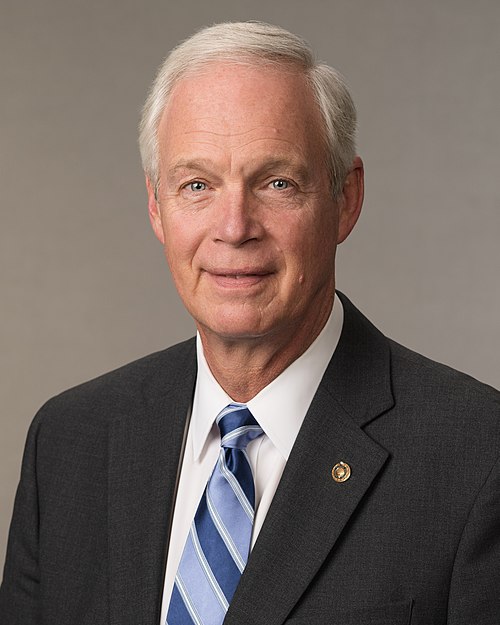

Wyden (Ranking Member) appears at the far left of the outer arc; Crapo (Chair) at the far right. Democrats cluster on the left, Republicans on the right.

Key Finance Committee Legislation

Recent tax, trade, and economic measuresNo Tax on Tips Act

The No Tax on Tips Act excludes tip income from federal taxation for eligible workers, effectively allowing service employees to keep more of what they earn. The bill directs the IRS to adjust reporting requirements and enforcement guidance so that tips are treated differently from base wages. Supporters argue it boosts take-home pay in hospitality and service industries, while critics raise concerns about revenue loss and tax fairness.

S.J.Res.88 — Terminating the Global Tariffs National Emergency

This joint resolution terminates the national emergency authority used to impose broad global tariffs on imports. By ending the emergency, it seeks to restore a more conventional, rules-based trade policy and reduce uncertainty for U.S. businesses and consumers. Proponents argue that unwinding the emergency will stabilize supply chains and lower costs, while preserving targeted tools to respond to unfair trade practices.

S.J.Res.81 — Terminating Duties on Imports from Brazil

S.J.Res.81 ends the national emergency used to levy special duties on articles imported from Brazil. The resolution aims to de-escalate trade tensions and avoid retaliatory measures that could harm U.S. exporters, especially in agriculture and manufacturing. It reflects a Finance Committee focus on balancing pressure over trade disputes with long-term economic stability and predictable market access.

S.J.Res.77 — Terminating Duties on Imports from Canada

This joint resolution terminates the national emergency underlying additional duties on imports from Canada. The measure is designed to protect integrated North American supply chains in sectors like autos, energy, and agriculture. Supporters contend that lifting these emergency duties will reduce prices for consumers and strengthen relations with a key ally and trading partner.

S.J.Res.49 — Terminating the Global Tariffs National Emergency (Failed)

S.J.Res.49 sought to terminate the same national emergency authority used to impose global tariffs but did not secure final Senate approval. The resolution became a high-profile test of congressional willingness to claw back tariff powers from the executive branch. Its failure highlighted partisan divisions over trade strategy and the proper balance between economic relief for importers and leverage in trade negotiations.

S.J.Res.37 — Terminating Duties on Imports from Canada

S.J.Res.37 also terminates a national emergency used to justify additional duties on certain Canadian imports. The resolution’s goal is to ease cost pressures on U.S. industries that rely on Canadian inputs and to head off escalation in cross-border trade disputes. It underscores the Finance Committee’s central role in overseeing tariffs, trade remedies, and the use of emergency economic powers.

S.J.Res.3 — Disapproving IRS Rule on Digital Asset Broker Reporting

S.J.Res.3 provides for congressional disapproval of an IRS rule on gross proceeds reporting by brokers that facilitate digital asset sales. The resolution reflects concerns that the rule could impose overly broad reporting obligations on software developers, miners, and other nontraditional actors in the crypto ecosystem. Its backers argue for more tailored regulation of digital assets, while opponents warn it may weaken tax compliance and transparency.