What the Committee Does

The Small Business and Entrepreneurship Committee writes and oversees laws that govern SBA lending, contracting programs, and counseling services. It examines how federal regulations, taxes, and red tape affect small firms’ ability to start, grow, and hire workers. The committee also looks at how capital, technology, and trade policies shape the competitive landscape for entrepreneurs.

Members hold hearings with small business owners, lenders, economic experts, and administration officials to identify both barriers and opportunities. They review how well disaster-programs, pandemic relief, and rural or underserved-area initiatives deliver on their promises. Through bipartisan negotiations and sometimes sharp debates, the committee pushes to keep small businesses at the center of national economic strategy.

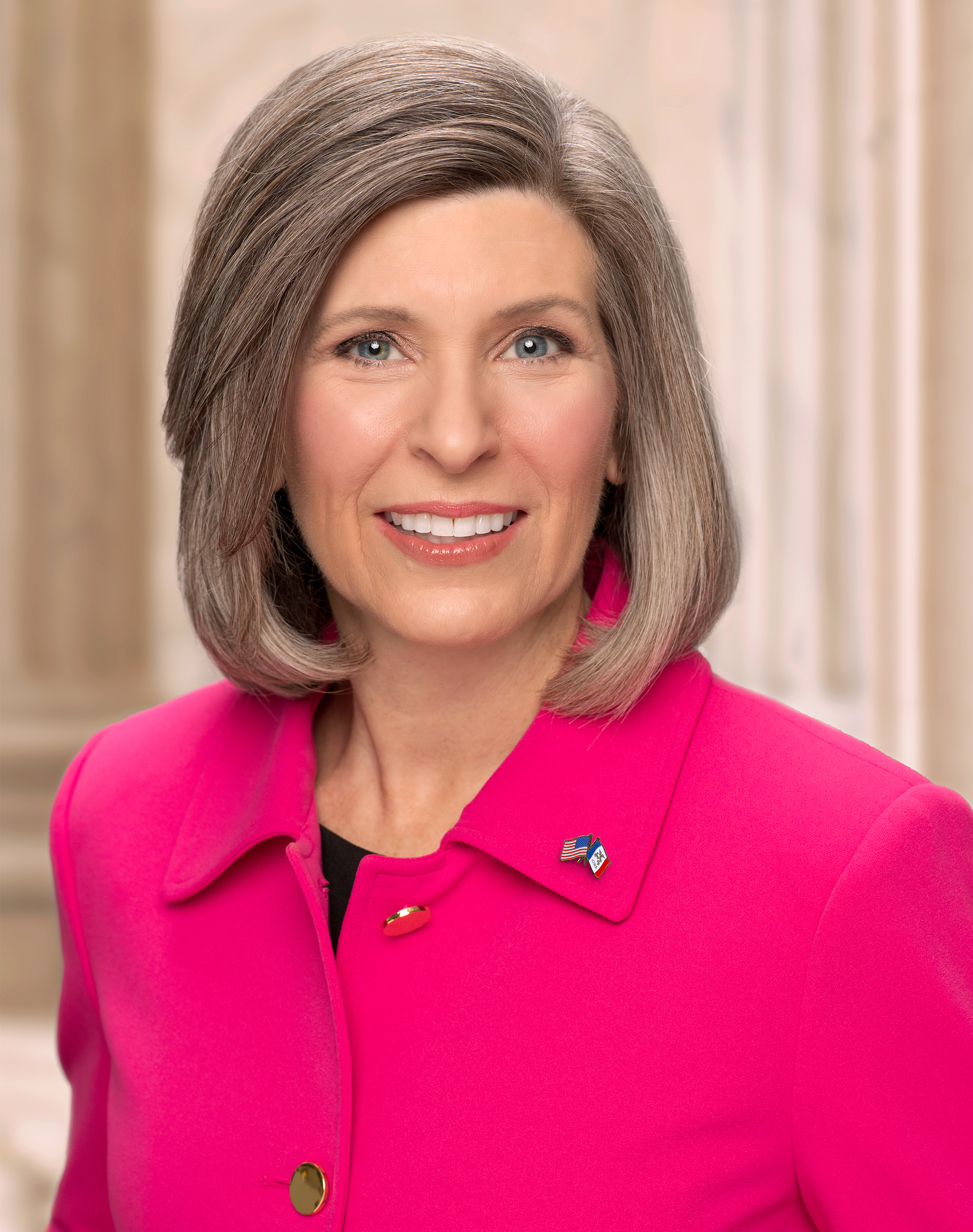

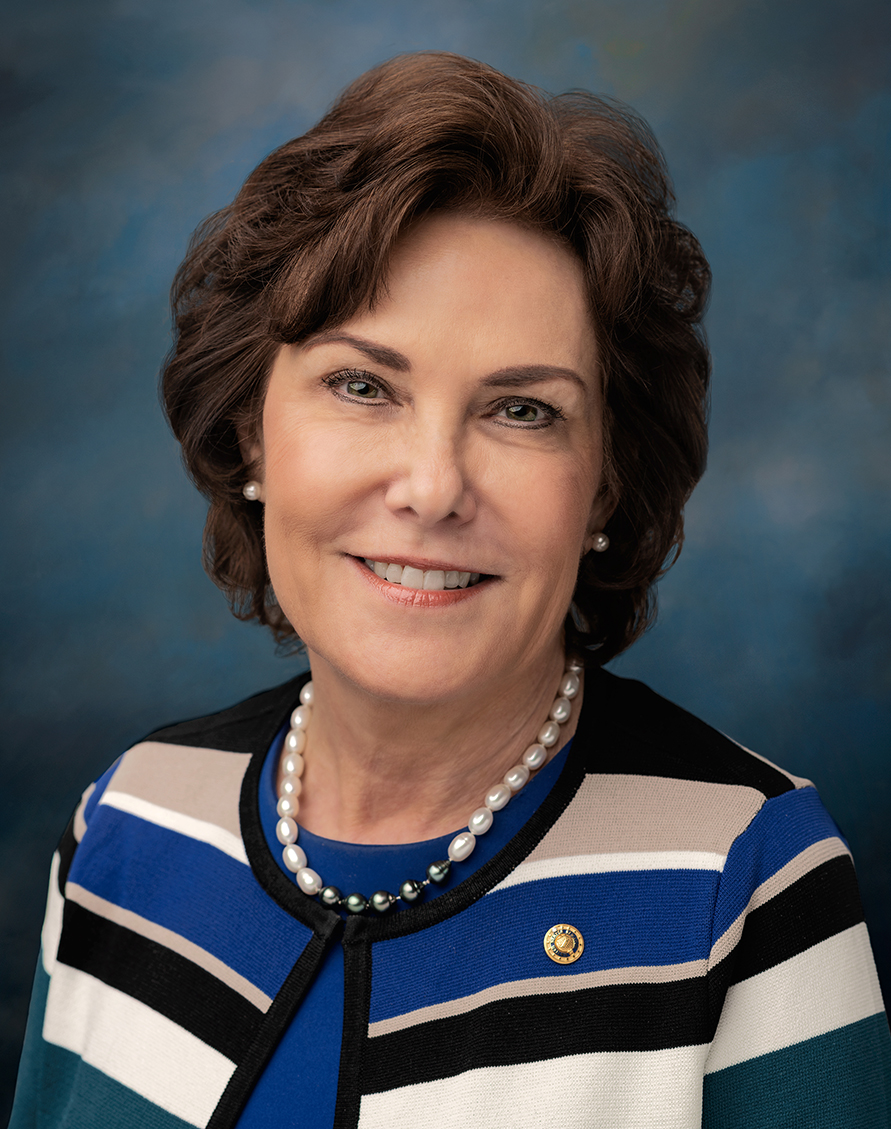

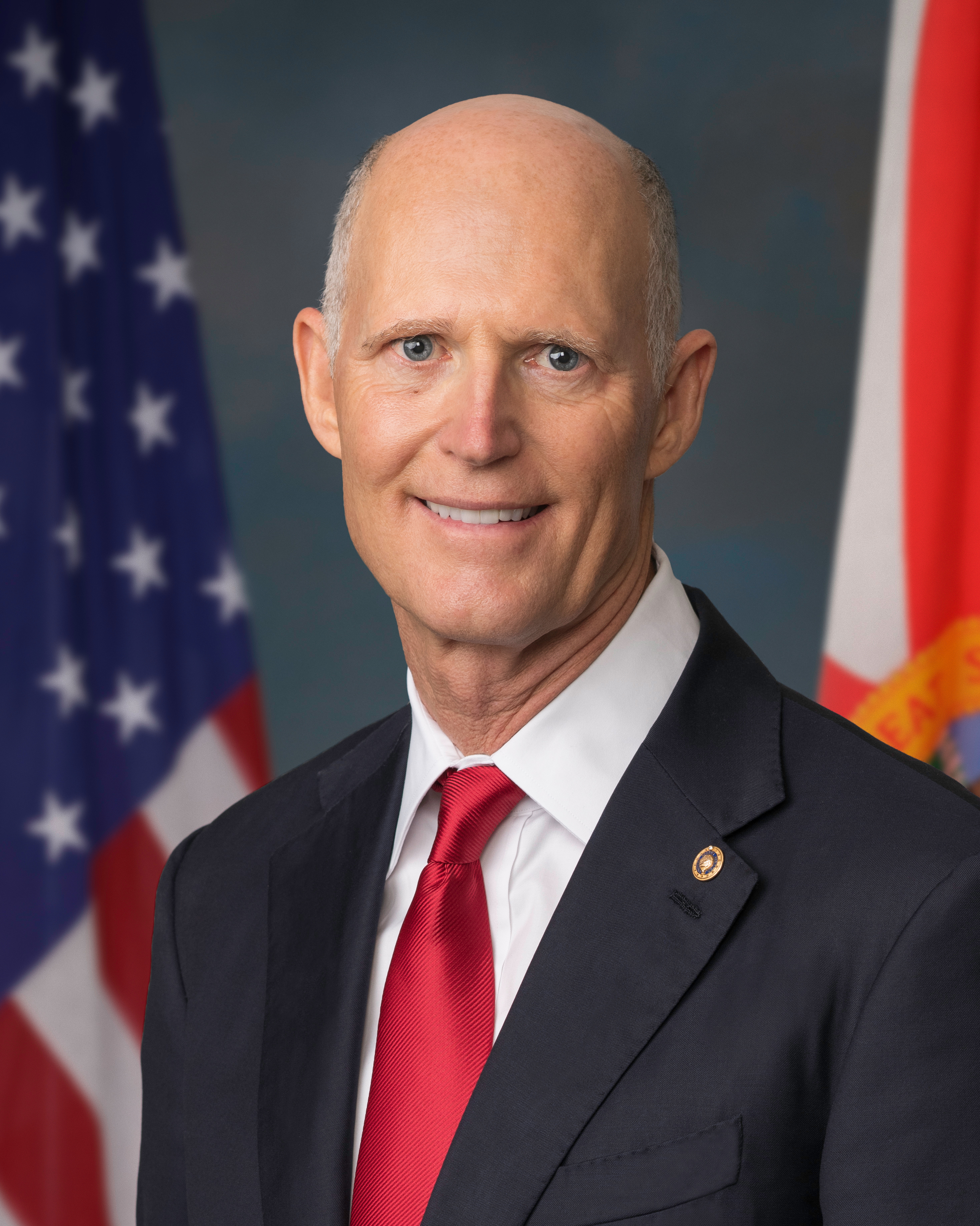

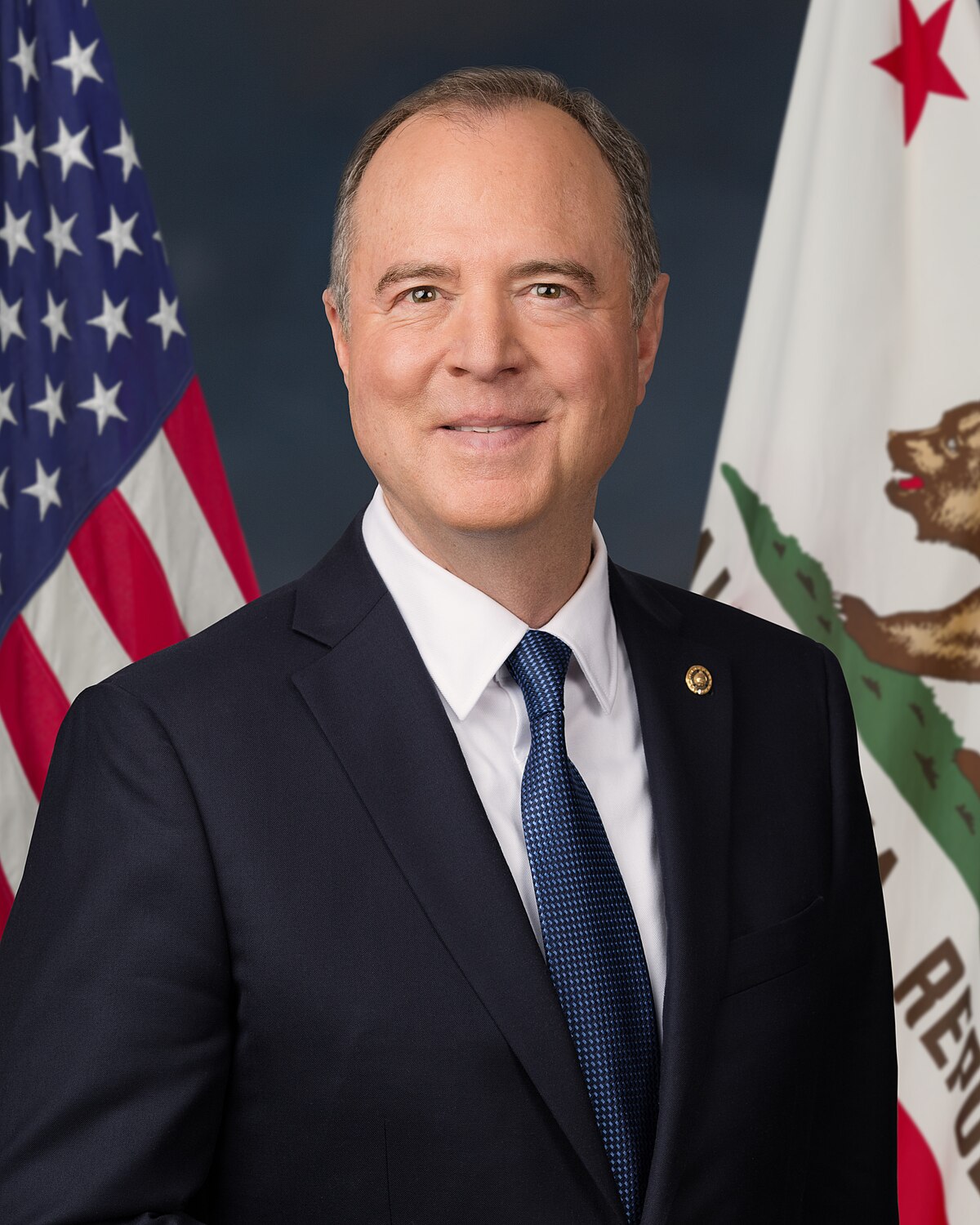

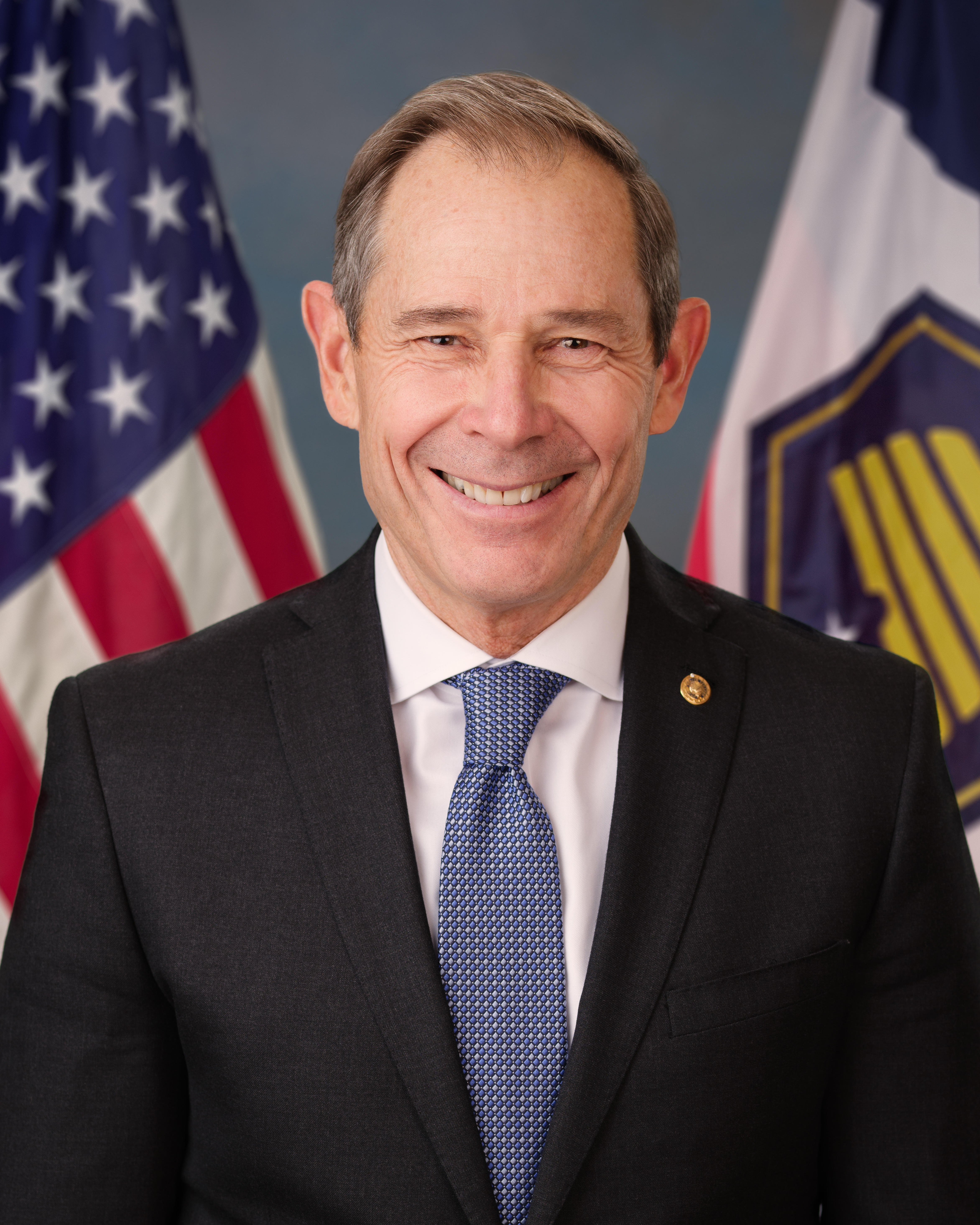

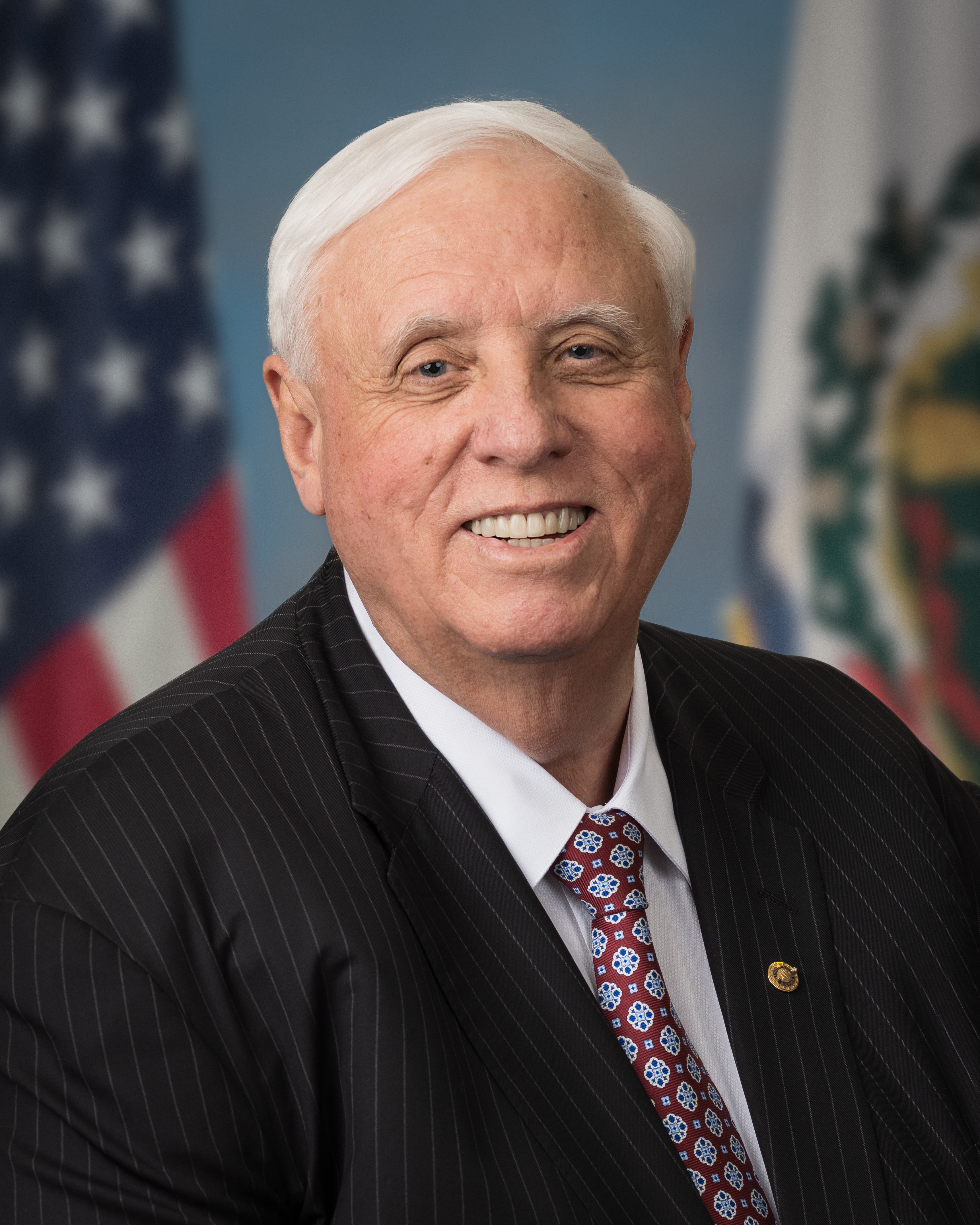

Committee Membership

Markey (Ranking Member) appears at the far left of the outer arc; Ernst (Chair) at the far right. Democrats cluster on the left, Republicans on the right.

Key Small Business & Entrepreneurship Measures

Recent proposals affecting SBA programs and entrepreneurs504 Modernization and Small Manufacturer Enhancement Act of 2025

This bill updates the Small Business Administration’s 504 loan program so it better fits the capital needs of modern manufacturers. It looks at streamlining rules, improving underwriting standards, and giving more flexibility for equipment and facility financing. The goal is to help small manufacturers expand, upgrade technology, and stay competitive in global supply chains.

504 Credit Risk Management Improvement Act of 2025

S.2659 focuses on strengthening how credit risk is measured and managed within the SBA’s 504 loan program. By pushing for clearer risk benchmarks and better coordination between lenders and SBA, it aims to reduce defaults while keeping credit flowing. Supporters argue that better risk management can protect taxpayers and give small businesses more stable access to long-term financing.

Expanding the Surety Bond Program Act of 2025

This bill expands SBA’s surety bond guarantee authority so more small contractors can qualify for bonding on public and private projects. The measure is especially important for newer firms and those in underserved communities that struggle to meet traditional bonding thresholds. By widening access, it seeks to open up construction, infrastructure, and service contracts to a broader set of small businesses.

Rural Small Business Resilience Act

S.1703 targets the unique challenges faced by rural small businesses, including limited capital, thin broadband access, and vulnerability to natural disasters. It enhances technical assistance, financing tools, and coordination among federal programs aimed at rural entrepreneurs. The bill’s backers argue that stronger rural businesses mean more stable jobs, healthier main streets, and more resilient local economies.

Small Business Liberation Act

This bill seeks to cut red tape and simplify tax and regulatory burdens that fall heavily on small firms. It examines ways to streamline reporting requirements, reduce compliance costs, and clear outdated rules that block growth. The legislation reflects a bipartisan interest in making it easier for small employers to hire, invest, and innovate without getting bogged down in paperwork.

Made in America Manufacturing Finance Act of 2025

S.1555 creates or strengthens financing channels specifically for small manufacturers producing goods in the United States. The bill pushes for more flexible loans and guarantees to support reshoring, supply-chain diversification, and advanced manufacturing investments. It is framed as both an economic and national security measure to keep critical production capacity at home.

SBA Fraud Enforcement Extension Act

This bill extends and enhances SBA’s authorities to investigate and prosecute fraud, especially scams tied to pandemic-era or emergency loan programs. It encourages stronger coordination with inspectors general, the Department of Justice, and other enforcement partners. Lawmakers hope that tougher oversight will protect honest borrowers while deterring sophisticated schemes that siphon off taxpayer funds.

Coordinated Support for Rural Small Businesses Act

S.1093 focuses on better aligning federal resources that serve rural entrepreneurs, from technical assistance to access-to-capital programs. It pushes agencies to coordinate outreach so rural businesses don’t have to navigate a maze of disconnected offices. By creating a more coherent support structure, the bill aims to help rural firms start up, scale, and survive economic shocks.

Assisting Small Businesses Not Fraudsters Act

This bill tightens eligibility rules and oversight mechanisms for SBA programs to ensure that genuine small businesses, not bad actors, receive support. It emphasizes data-sharing and improved vetting to detect shell companies or identity theft before funds go out the door. The proposal responds to lessons learned from pandemic assistance programs where fraud levels were unusually high.

INNOVATE Act

S.853 is aimed at helping innovative startups and research-heavy small firms bridge the gap between ideas and commercialization. It supports grant and loan programs that fund early-stage R&D, technology transfer, and partnerships with universities. The bill underscores the committee’s view that small, cutting-edge companies are central to long-term U.S. competitiveness.

Prove It Act of 2025

This bill requires agencies to do more rigorous analysis of how new regulations affect small businesses and to justify those burdens publicly. It pushes for better data, clearer cost estimates, and more consultation with small firms before rules are finalized. The goal is to make regulators ‘prove’ that compliance costs are reasonable and alternatives have been considered.

SBA Disaster Transparency Act

S.371 aims to bring more transparency and accountability to SBA disaster-loan programs. It calls for clearer reporting on where disaster funds go, how quickly applications are processed, and how well outreach reaches affected small businesses. By shining light on performance, lawmakers hope to speed assistance and close gaps that leave some communities behind.

CCP IP Act

The CCP IP Act looks at the intersection of Chinese intellectual-property practices and the vulnerabilities of U.S. small businesses. It presses for tools to protect the IP of small firms that are targets for theft or coerced technology transfers. The measure signals growing concern that geopolitical competition can directly harm smaller innovators, not just large corporations.

Small Business Technological Act of 2025

S.305 encourages small businesses to adopt new technologies—from cybersecurity tools to digital bookkeeping and e-commerce platforms. It supports grants, technical assistance, and pilot programs that lower the upfront cost of modernization. The bill’s authors argue that tech adoption is now essential for small firms to compete with larger, more resource-rich rivals.

DLARA

DLARA focuses on easing regulatory burdens that fall disproportionately on small businesses, particularly in lending and licensing. It seeks to streamline rules, clarify guidance, and eliminate duplicative requirements that drain time and money. Supporters frame it as a way to free entrepreneurs to focus on customers and growth rather than navigating bureaucracy.

Returning SBA to Main Street Act

This bill is about reorienting SBA’s focus toward the needs of truly small, local Main Street businesses. It reviews agency priorities, outreach practices, and program design to ensure microbusinesses and very small firms are not overshadowed by larger borrowers. The legislation reflects anxiety that some SBA efforts have drifted away from neighborhood storefronts and family-owned enterprises.

Small Business Child Care Investment Act

S.273 supports small businesses that provide child care or partner with child-care providers, recognizing the sector as critical economic infrastructure. It offers tools like grants, loans, and technical assistance to expand capacity and improve quality. By stabilizing child care, the bill aims to help more parents—especially in small communities—participate fully in the workforce.

RED TAPE Act

The RED TAPE Act targets broad, cross-government regulatory burdens that weigh on entrepreneurs and small employers. It encourages agencies to identify obsolete or overlapping rules and to consider repeal or simplification. The bill is meant to complement more targeted small-business reforms by changing the overall culture around regulation and paperwork.

Complete COVID Collections Act

S.68 addresses the long tail of COVID-era lending and relief programs that are still being reconciled. It looks to ensure that outstanding debts and overpayments are collected fairly, transparently, and with sensitivity to small-business cash-flow realities. The legislation also aims to extract lessons from pandemic programs that can guide future emergency responses.

Authorizing expenditures by the Committee on Small Business and Entrepreneurship

This resolution authorizes funding and staff resources for the Senate Committee on Small Business and Entrepreneurship for the current Congress. It lays out how the committee can spend money on hearings, investigations, and other official work. While procedural, it underpins the committee’s ability to conduct oversight and develop legislation on behalf of small firms nationwide.