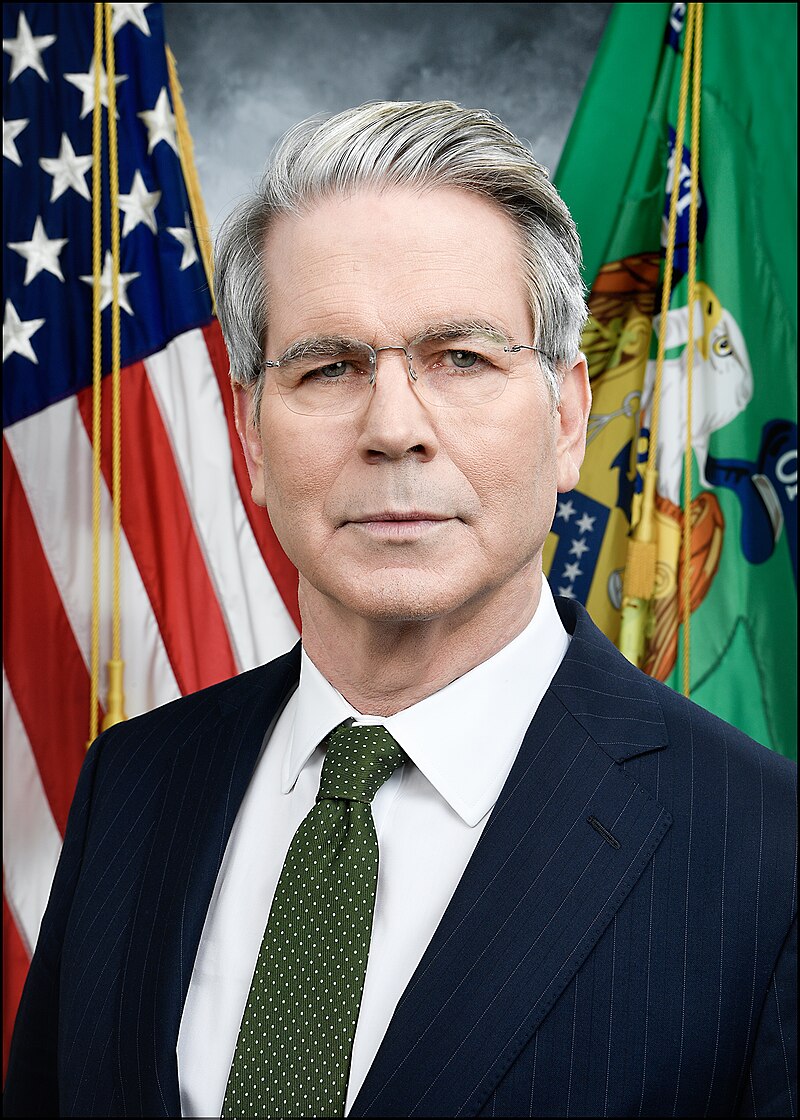

Scott Kenneth Homer Bessent is a global macro finance operator who moved from currencies and sovereign risk into U.S. state power. He is the 79th Secretary of the Treasury, serving since January 28, 2025 in the second Trump administration, after Senate confirmation on January 27, 2025 by a 68 to 29 vote. His governing style treats market credibility as infrastructure: not mood, but a strategic asset that controls borrowing costs, sanctions effectiveness, and the dollar’s trust premium.

Bessent grew up in Conway, South Carolina, in a family shaped by local business and instability. He worked early (including a childhood busboy job), graduated from North Myrtle Beach High School in 1980, and considered the Naval Academy but chose not to pursue it because he was unwilling to lie about his sexual orientation. He graduated from Yale in 1984 with a BA in political science, where he held high-status campus roles (Yale Daily News board, Wolf’s Head Society president, class treasurer) and built early finance access through a Yale connection to Jim Rogers of the Quantum Fund ecosystem.

His investing career is built around moments where politics snaps into price. After early stints at Brown Brothers Harriman, the Olayan Group, and Kynikos Associates under Jim Chanos, Bessent joined Soros Fund Management in 1991 and rose into the center of the firm’s macro machinery. In September 1992, he was a leading member of the Soros team that profited over $1 billion from Black Wednesday and the pound sterling crisis. Later, after returning to Soros Fund Management as chief investment officer from 2011 to 2015, he generated more than $1.2 billion in gains in 2013 by betting against the Japanese yen in a concentrated three-month move.

Between Soros chapters, Bessent ran his own hedge fund (Bessent Capital, founded after leaving SFM in 2000 and closed in 2005), and he taught at Yale as an adjunct professor of economic history from 2006 to 2011. In 2015, he founded Key Square Group, a global macro hedge fund built around geopolitics-plus-economics positioning. Key Square launched with a major anchor investment (including a $2 billion Soros commitment) and became known for a mixed, volatile track record through 2021 before stronger performance in 2021–2023 and a “double digits” 2024 gain tied to a post-election U.S. equities thesis. Upon becoming Treasury Secretary, Bessent said he would sever ties with the firm.

Politically, Bessent is a convert in coalition terms but a consistent operator in power terms: he has fundraised for Democrats in the past, then moved into Trump world as an economic adviser, major donor, and top-tier fundraiser during the 2024 cycle (including high-dollar events in South Carolina and Palm Beach). In office, he has combined a strong-dollar message with aggressive institutional control: opening Treasury systems to the Department of Government Efficiency team, briefly taking acting control of the Consumer Financial Protection Bureau and ordering a halt to agency work, and treating Treasury as the switchboard for enforcement, credit allocation, and strategic industrial leverage.

Bessent is also historically notable on representation: he is the first openly gay person to lead the Treasury Department and the first openly gay Senate-confirmed Cabinet member in a Republican administration. He lives between Charleston and Washington, is married to John Freeman, and they have two children. His public image blends old finance networks with hard-edged political combat: a macro technician who is willing to fight loudly when the coalition demands it.

Mainstream Conservative

Achievements

- Built a reputation as a high-impact macro investor, including leading roles in major Soros Fund Management wins such as the 1992 pound sterling trade (Black Wednesday) and the 2013 yen short that produced more than $1.2 billion in gains.

- Founded Key Square Group in 2015 as a geopolitics-driven macro shop, institutionalizing his view that state decisions are the core risk factor in modern markets.

- Entered government with unusually strong market credibility and communications discipline, positioning Treasury as the anchor for dollar policy, auction confidence, and sanctions enforcement.

- Became the first openly gay Treasury Secretary, breaking a major institutional barrier and reshaping the symbolism of Republican Cabinet-level leadership.

- As Treasury Secretary, moved quickly to assert operational control over financial governance machinery, including payments systems access decisions and interim leadership actions tied to consumer finance oversight.

Controversies

- Critics argue his Treasury posture prioritizes market stability and institutional confidence over distributional outcomes, making “credibility” the north star even when households absorb the shock.

- Granted the Department of Government Efficiency team access to the Treasury payments system (late January 2025), triggering concern about operational risk, political control, and data governance.

- As acting director of the Consumer Financial Protection Bureau (early February 2025), he ordered the agency to halt work, which opponents framed as an attempt to neutralize consumer enforcement.

- Reported internal disputes over IRS leadership and an ethics agreement compliance issue drew scrutiny about process, influence, and the limits of “technocratic” branding.

- High-profile clashes (including a January 2026 feud with California Governor Gavin Newsom) reinforced the view that he mixes macro management with culture-war level messaging.

Senate Confirmation Vote

Votes For

Votes Against